We all have a dream of owning a house someday and if you’re also thinking the same then this article is for you. Here we are going to talk about how to plan to buy a house. Owning a house is a long-time financial commitment and so you should plan carefully to avoid any future issues.

This planning on steps to buying a house in the USA should be from all prospective like finance, location, space, features, and more. Your research should be diversified across all these areas to get the home you are dreaming of.

As per the report of statistical firm statista, more than 65% of people in the US own home and this graph has seen positive movement from 2016. So, we can say, people, are now more attached to owning a home rather than just renting.

But before we jump on the steps to buying a house in the USA, make sure you need one. Due to the nature of your job if you keep on changing the location probably it might not be a good time to buy a heavy home unless you plan for investment as well.

5 steps to buying a house in the USA

Let’s start with the top steps on how to plan to buy a home and look for the different factors you should check.

#1 Start your research early

As soon as you start thinking about buying a home, you should start working on the research. Buying a home is not an easy deal and it takes time. If you’re new to the location and don’t know much about the real estate industry then it might even take 6-12 months to do research thoroughly and finally buy one.

Your research should include the following- size, area, pricing, features, greenery, and more as per your requirements.

As per the report by Business Insider, the median listed price of a home is nearly $280k. But this varies heavily by the states and region as you can see in the below trend.

So, first, decide the region where you will buy and then start planning for it. Although the median price is just $280k but for Washington, it is $691K which is more than double of the national median.

#2 Understand monthly mortgage payment

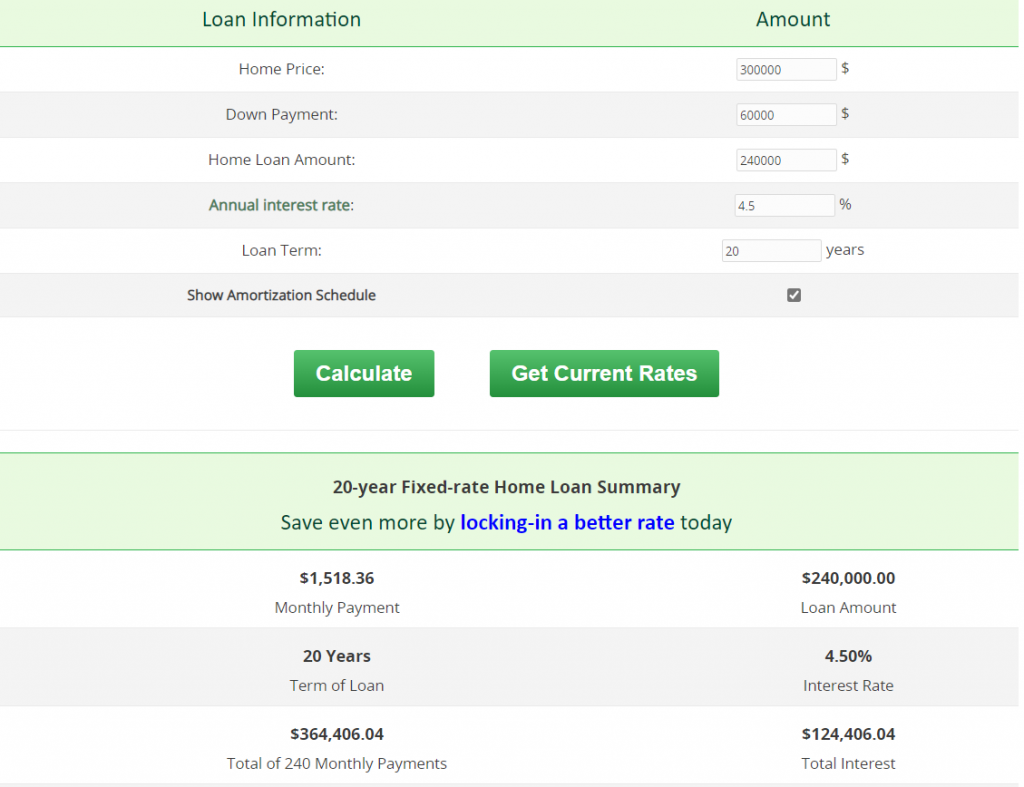

If you’re planning to go with the mortgage then make sure you understand how much you need to pay them back. You can use the calculator to understand how much you need to pay monthly on your mortgage. The calculator I am using here is provided by Mortgage Calculators and helps you plan your mortgage in a better way.

For example, Let’s say you’re planning to buy a home of $300k with a down payment of 20%. In that case, the mortgage will be $240k. Considering an annual interest rate of 4.5% for a 20-year loan, you need to pay around $1.5k per month. So, you can also use this calculator and plan your mortgage monthly payment.

#3 Find the right real estate agent for you

Whenever you are done with the first two steps where you understand the location and budget, it’s time to look for real estate agents. Find the agent who can help you find the best home as per your requirements and budget. They are best with the home buying process including negotiation skills, documentation, legal works, and more. The better agent you can find, the best deal you’re going to get.

#4 Get your home inspection

Just don’t believe in the information available online or what your agents have told you. Those might be misleading as well and might not show the correct picture. You should plan to visit the home you have shortlisted and inspect. Make sure it is fulfilling most of the parameters you have set.

#5 Have the home appraised

The lender will arrange for the appraiser to provide an independent estimate of the value of the house you are buying. The appraiser will be a member of an independent company and will not be associated with the lender. The appraiser will help you understand the fair price of the deal as per the various parameters.

Conclusion

Buying a home is everyone’s dream and should be planned very carefully. I have talked about some of the important steps to buying a house in the USA. I have also talked about some data and calculator which can help you plan your dream home in a better way.

Leave a Comment